How AI in Finance Is Tackling Major Accounting Hurdles

Many small business owners and decision-makers in the US, dealing with accounting, have often been caught up in a sea of tedious manual data entry and that nagging uncertainty about cash flow. But these days, AI software for accounting is turning those daily headaches into real chances for smarter, quicker, and more strategic financial management.

What Are AI-Powered Accounting Solutions?

Alright, let's face it, one of the biggest challenges for small and midsize businesses (SMBs) is the sheer volume of repetitive, error-prone tasks. This is where AI-powered accounting solutions step in and make a noticeable difference:

- Automating Tedious Tasks: These systems take care of data entry and sorting transactions, which lets accountants and business owners reclaim precious time. Picture AI as your tireless assistant, always there to lend a helping hand with the vital, yet kind of boring, aspects of managing finances.

- Enabling Strategic Focus: With the routine tasks out of the way, SMBs can really hone in on strategic and value-driven activities that can spark business growth.

Streamlining Accounting with Intelligent Automation

Now, let’s chat about intelligent accounting automation. This stuff is really changing the game. We’re talking about making simple tasks, like:

- Processing invoices

- Reconciling bank accounts

- Managing payroll

By cutting down on human error, businesses can boost the accuracy of their financial reports, which leads to better decision-making and smoother compliance with financial rules.

Gaining Insights with Smart Accounting Software

Modern accounting software isn’t just about numbers; it dives into heaps of data in no time and offers predictive analytics to forecast financial trends. This gives businesses the power to:

- Find insights that, honestly, were just not possible before

- Make proactive, data-driven decisions

- Keep ahead in competitive markets

Real-Time Financial Visibility

Many SMBs often struggle to see clearly into their current and future financial states, which can feel pretty risky in today’s unpredictable markets. But AI-driven dashboards are changing that game:

- You get real-time updates on cash balances, invoices, and tax responsibilities

- Instant, actionable insights help you make confident and timely decisions

Artificial Intelligence in Bookkeeping

AI bookkeeping tools allow businesses to maintain up-to-the-minute financial records, which is super important for tracking cash flow and expenses—especially for small firms. This kind of clarity paves the way for more strategic planning and a healthier financial outlook.

From Manual Reports to Predictive Insights

The days when only big corporations could afford fancy forecasting tools are behind us. Advanced AI solutions like QuickBooks are now delivering:

- Smart cash flow forecasting based on what’s happened before and likely future expenses

- Noticing anomalies, offering cost-saving tips, and making suggestions for paying bills or collecting funds

This way, even the smallest of businesses can plan ahead and avoid nasty surprises.

Smarter Compliance and Risk Management

Let’s be honest—navigating tax rules and keeping fraud at bay can be pretty overwhelming for any small business. AI simplifies compliance by:

- Never-sleeping monitoring of transactions to spot unusual patterns or discrepancies

- Flagging potential errors or risks of fraud

- Helping with tax filings and keeping up with regulatory changes to lower the risk of audits or penalties

AI for Financial Automation & Fraud Detection

AI-driven automation is a key player in fighting fraud:

- It identifies and flags those odd patterns for review

- It works to mitigate financial risks and protects company assets

Leveling the Playing Field for Small Businesses

A pretty significant trend we’re seeing in 2025: AI accounting software is becoming accessible and affordable for smaller companies, not just the big players. Small businesses can now tap into the same efficiency, accuracy, and analytical insights that were once reserved for large enterprises—this means they can compete and grow with renewed confidence.

Platforms like QuickBooks, Xero, and FreshBooks automate essential but time-consuming jobs—like sorting transactions, extracting bills, payroll, and so much more—allowing business owners to regain hours once lost to manual bookkeeping, reduce mistakes, and make the closing process a whole lot easier.

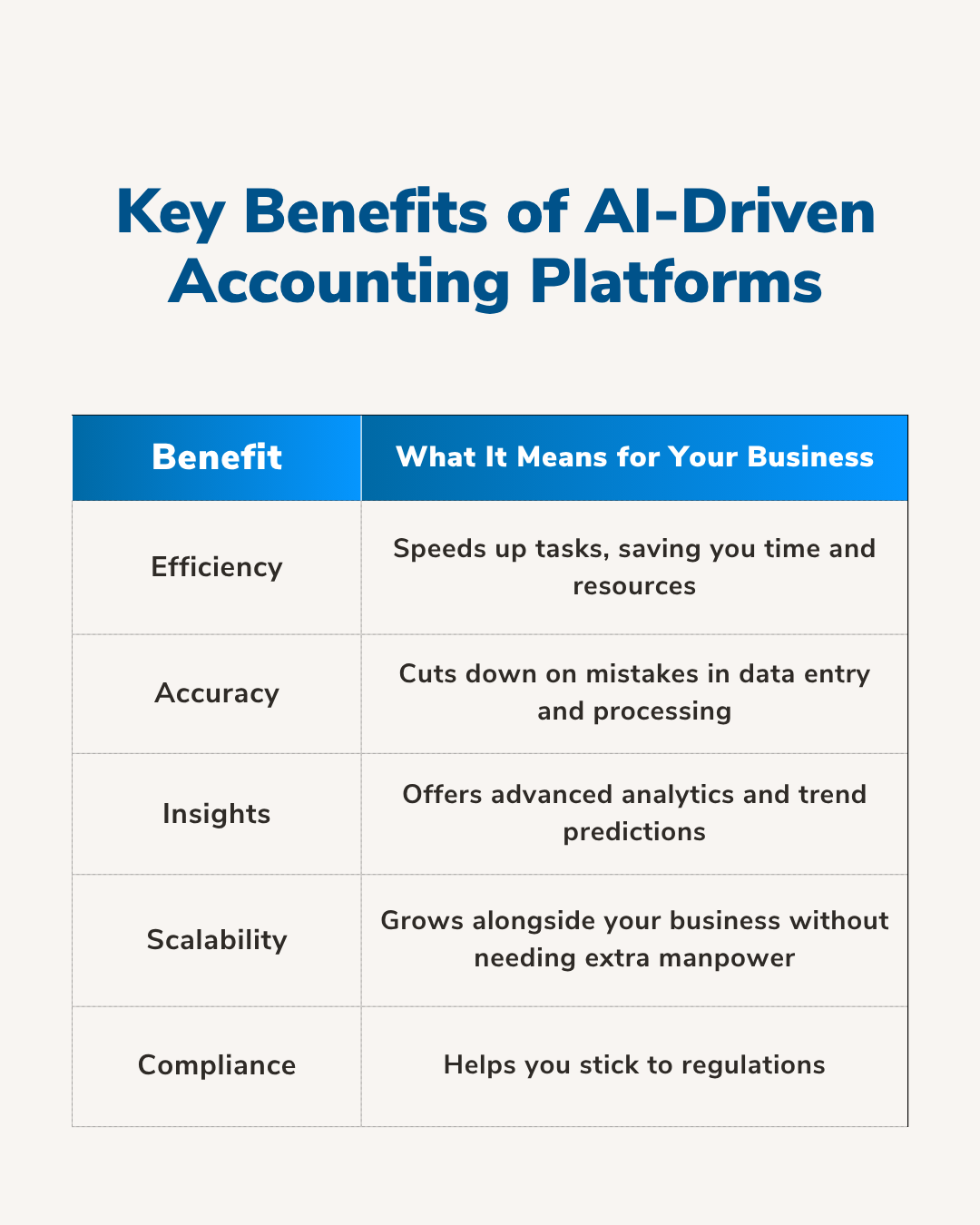

Key Benefits of AI-Driven Accounting Platforms

AI in finance is always changing. It doesn’t replace human accountants; rather, it enhances what they do, giving them more breathing room to concentrate on analysis, strategy, and client support.

By using these tools, businesses can meet the challenges of today's financial world head-on and take on fresh opportunities. Visit CollabAI for more details about AI software and custom AI agents.

DRUPAL: The CMS you must be looking for!

Culture & happiness in SJI